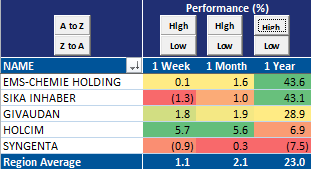

Swiss materials companies, however, have managed somewhat more respectable performance over the same time period:

When we look at the individual companies on a long term, relative strength basis, some positive (or potentially positive) patterns emerge.

Holcim's stock price is nestled comfortably in a multi-year base of support:

Syngenta seems to be re-testing support levels that go back to late 2010-- will it rally back above the 45-degree bullish support line?

EMS-Chemie continues in a steady, structural uptrend:

In a pattern somewhat similar to that of Syngenta, Givaudan's stock took a quick peek above resistance and appears to be verifying support:

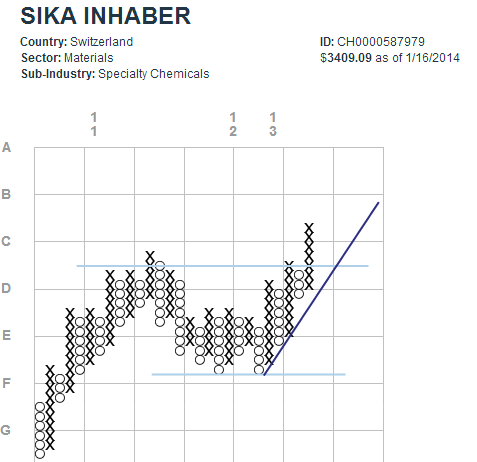

Finally, in what is arguably the most attractive point-and-figure formation among its Swiss Materials peers, the chart for Sika Inhaber shows its price making a definitive breakout above the resistance established two years ago:

Perhaps the outperformance of the Swiss stocks has something to do with their average investment in R&D (as a percent of sales) of 4.5%? The corresponding figure for all of MSCI Europe Materials companies is just 1.3%.