Today's release of the ZEW financial market survey for Germany revealed a surprising increase in economic expectations, compared to the consensus for a marginal improvement:

chart note:

dark blue = balance

red = improve

light blue = no change

black = worsen

Meanwhile, the question on current economic conditions revealed no change from low levels reached a month ago:

Inflation expectations and the outlook for interest rates continue to fall, while hopes for an improvement in the DAX have risen, on balance:

Profit expectations are looking brighter in a few industries, led by large increases in the Machinery and Electronics groups.

Chemicals

Information Technology

Consumer Goods & Retail

Services

Machine Construction

Construction

Electronics

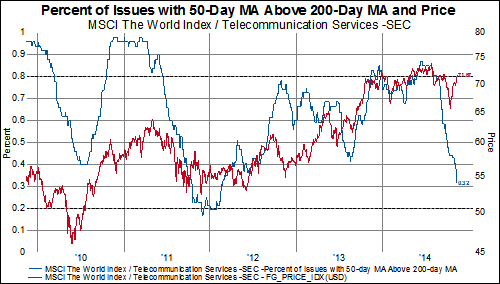

Telecommunications

Conversely, the outlook for Financial, Utility, and Auto industries continues to be less promising, according to the 220 analysts queried in this month's survey:

Vehicle Construction

Steel

Utilities

Banks

Insurance Companies

As the first in a long list of economic sentiment surveys, the question remains as to whether or not those in other countries will follow: