Today, let's take a closer look at the MSCI World Consumer Discretionary sector. As always, we look at everything from an equally weighed, intangible-adjusted basis. Consumer discretionary companies are diverse bunch. Businesses in this sector range from advertising to homebuilders and from casinos to auto makers. There are 243 companies in the consumer discretionary sector and it accounts for just over 15% of the overall MSCI World Index. From a regional perspective, 46% are in North America, 23% are in Europe, and 31% are in Asia-Pacific.

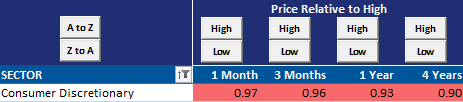

This sector has been on quite the roll. It is up 47% over the past year and 129% over the past year 4 years. This group has far outperformed the MSCI World Index (64% relative outperformance over 4 years). 84% of the stocks are trading above their 200-day moving average and 16% are making new 200-day highs. Remarkably, 228 out of the 243 stocks (94%) are higher than they were one year ago and the average stock is only 7% of their one year high and 10% of their four year high.

There is a tremendous amount of sales and earnings growth expectations baked into these stocks. On average, sales are expecting to grow by 7.5% a year and earnings are expected to grow by an aggressive 15% a year. If the most recent 10-years of history are any indicator, these hurdle rates may be hard to jump.

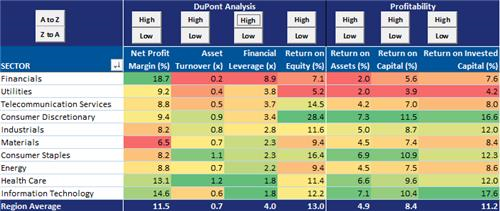

This sector continues to have above average margins and profitability. They do, however, have the fourth highest financial leverage behind financials, utilities, and telecom.

From an intangible-adjusted perspective, their valuations level's aren't cheap by any means but they aren't quite as rich as you might have guessed given their strong outperformance over the past four years. Consumer discretionary companies are trading at a much higher P/B metric than the average stock (nearly 2x) and 81% of stocks are trading above their 7-year P/S average . Finally, currently 39% of stocks are trading at a P/E of 20 or above