Every day we count the number of stocks that

were up and the number that were down. From there, we create a ratio of

advances/declines (stocks up and stocks down). Importantly, the a/d line

is measure of breadth. If the a/d is 2/1, then 66% of the stocks were up

and 33% of the stocks were down. If the a/d ratio is .66, then 40% of stocks

were up and 60% were down. We then take that daily calculation and perform

various additional calculations, such as looking at the

200 day moving average or the 1 year cumulative sum. For the cumulative

sum, we just keep a running total of the daily a/d calculation for 252 trading days

(1 year).

It is important to note that we calculate our own stats for equal-weighted

market indices. Equal-weighting is an important first step in analyzing

market internals. Whether it’s a/d ratio, net advances, or new highs, the calculations are based the number of companies, not the size. North

America is about 44% of the equal-weighted MSCI World index.

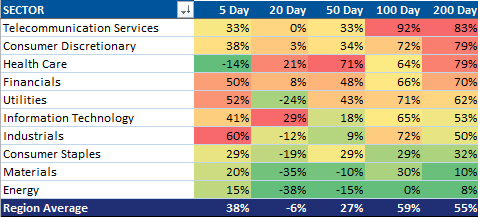

Looking more closely at Europe (but keeping in mind that trends between regions are mostly similar right now), we see that there are 442 companies in the MSCI Europe Index. Below is the (equal-weighted) sector breakdown:

The 200 day a/d line has fallen from 9/1 in

early 2012 to 2.5 today. That means as of December 2012, over the previous

200 days, 90% of the stocks were up and only 10% down. Currently, with a

reading of 2.5/1, roughly 71% of the

stocks were up and 29% were down over the last 200 trading days. If, for the sake of argument, the a/d ratio was

1/1 (50% of stocks were up and 50% were down) every day for 1 year, the 1 year cumulative

a/d ratio would be 252. The current reading is about 1,000 (which means

the a/d ratio averaged roughly 4.3/1 over the last year).

Breadth is clearly deteriorating-- and a few more data points reinforce this observation. Over the last 200

days, a net 83% of European telecom stocks rose. At the same time,

only a net 8% of European energy companies experienced positive

performance. The deteriorating breadth in Europe is due largely to three sectors: energy, materials, and staples.

An important complement to breadth is to measure

the percent of days that stocks are up and down. While breadth has been

deteriorating over the last year, this effect has been overwhelmed by the fact

that stocks have experienced more days up than down. We measure the

trailing 88 days of returns and calculate the percent of days stocks were up

and the percent of days they were down. The current reading is 50%, so

over the last 88 days, European stocks were up 44 days and down 44 days.

Notice that all year so far this metric has been above 50% (1 year moving average is

59%, green line) meaning that there were more days when stocks were up than down. 2013

is the first year since the March 9, 2009 low where the percent of up days has

been over 50% all year long. As one can see in the chart below, the last

time stocks were this detached from a “random walk” was 2006/2007, and

importantly this metric started sliding almost 1 year prior to the 2007 peak in

prices. It sort of looks like mid-2007 according to this metric…

So, to sum up, underlying the rise in European stocks over the last year were two factors:

1. Declining breadth-- fewer stocks are going up relative to those going down.

2. Statistical run-- almost 60% of all trading days have been up over the last year.