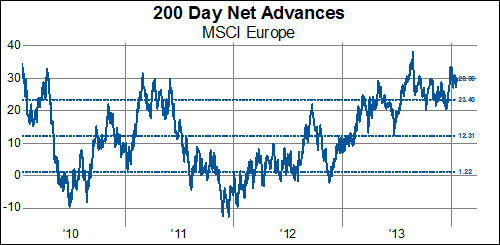

MSCI Europe remains quite overbought, in spite of a slight pullback more recently. In contrast, MSCI North America and MSCI Pacific have fewer companies making persistent new highs:

Volume turnover in Europe is the highest among the three regions, led by the Financial and Health Care sectors:

Followed closely by North America, Europe has the highest 65-day correlation with the MSCI World Index-- a measure that has, however, declined since the beginning of this year:

Performance in MSCI Europe has been better than the World average over the last 1- and 3-month time periods:

Putting together a number of our technical variables, we calculate a statistic to approximate the risk building in a particular system. For the MSCI Europe, the trend has been gradually up over the last couple of years.

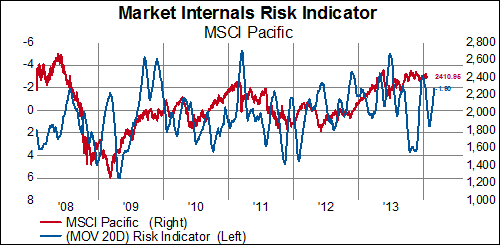

Conversely, our risk indicators for the Asia Pacific and North American regions have remained relatively stable or started trending down.