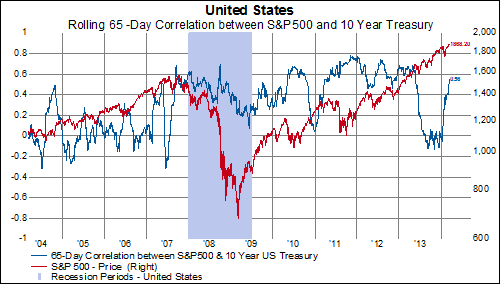

In the years after the Global Financial Crisis (2009-2012), correlations were extremely elevated, reflecting extreme deflation tail risk. In 2013, with the backdrop of another round of quantitative easing, shorter-term correlations plunged, suggesting the market was pricing out extreme deflationary risks. This was a good environment for stocks.

Now, shorter-term correlations between stocks and bonds have flipped strongly back into negative territory. This suggests the market is quickly re-pricing the likelihood of a deflationary shock.

A surge in the correlation between stocks and bonds preceded the 2010 and 2011 equity market corrections. The recent increase is a red flag for stocks.