As frequent readers have observed, we are keen track the relationship between individual stock performance and the fundamental and macro qualities of those stocks to help us get a sense of the factors that seem to be most important in driving stock returns. The way we do this is to generate factor rankings for each company and then regress those rankings against each individual stocks' performance over the periods we measure. We are then able to determine the r-squared (a measure of explanatory significance) for each factor and quickly understand which factors have been important and which have not.

The most recent output of our factor work is below and it shows that dividend yield was the most important factor driving stock returns last week as this factor alone was able to explain 96% of stocks' performance. Somewhat surprising is that even as the "MOMO" names have been taken to the woodshed over the last week, valuation measures (such as P/E) and quality measures (such as ROE) were not close to the most important variables driving stock returns.

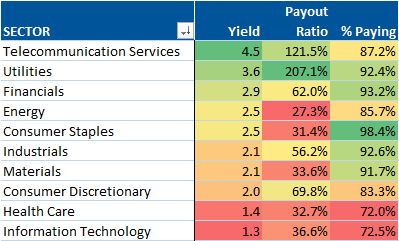

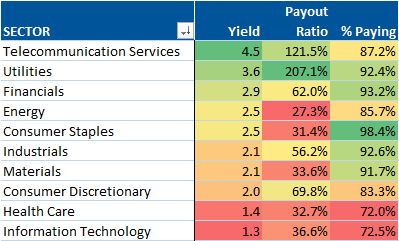

Now we know why utilities, telecommunications, energy and staples outperformed last week...