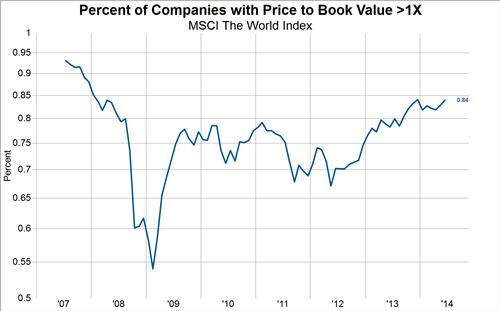

With that in mind, we find value in measuring how many stocks are trading above the book value of their equity. When a lot of stocks are trading above book value, like now, the market is pricing very few corporate equity dilutions or bankruptcies. When a lot of stocks are trading below book value, like in 2009, the market is pricing many businesses for bankruptcy.

In the below charts we measure the percent of companies in the MSCI World Index trading above book value and we also show the measure for the three MSCI developed market regional indexes. The results pretty clearly show that the market is pricing the lowest risk of corporate bankruptcies or equity dilutions since 2007, with 84% of stocks trading above book value. This is most pronounced in North America, where fully 94% of stocks are trading above book value compared with just 65% of companies trading above book value in early 2009.

Legendary investor Benjamin Graham had a rule of thumb when buying stocks to only buy when one is fairly certain that the stock in question is trading at a 30% or more discount to intrinsic value. Intrinsic value can be defined in any number of ways, but if one were using the book value of equity as an approximation then one would have very few choices at this point in time.