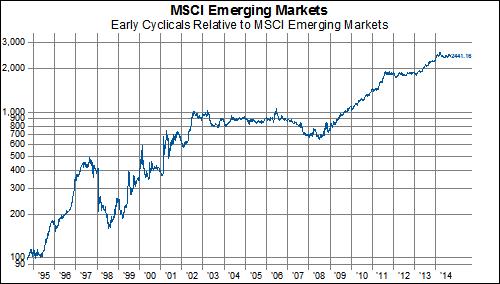

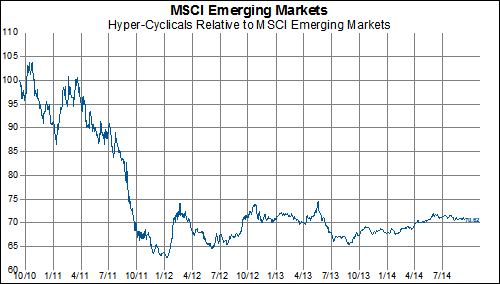

The following charts are going to look at how Emerging Market hyper-cyclicals have performed against the MSCI Emerging Markets Index across a variety of times slices. The punch line is unless you got in during a select few periods over the past few years, you haven't outperformed in a long, long time. In ascending order from year-to-date to 20 years ago.

And just for fun, it pays (BIG) to bet on the consumer...