WTI Crude Oil has fallen by about 45% over the last six months:

We've also seen the copper price (the metal with the PhD in economics) slide to another cycle low...

And bond yields in developed economies make new cycle and/or all-time lows:

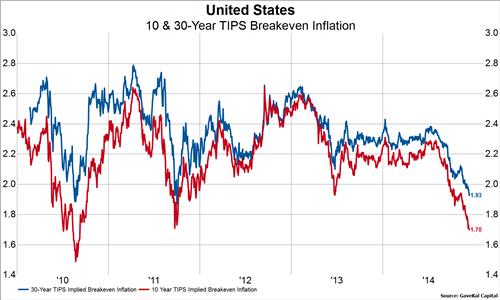

Derived inflation expectations are tanking:

And the yield curve is undergoing a bull flattener (a bearish sign):

Meanwhile only five out of twenty three developed market country's stock markets are positive YTD, with the US being the only major country to post positive performance:

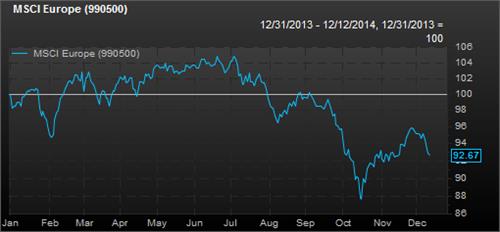

Europe is down 7.5% in USD terms:

While developed Asia is down 5% in USD terms:

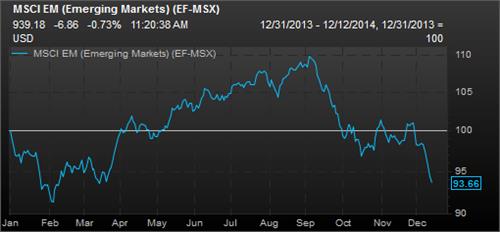

And EMs are down 6.5% in USD terms: