As another relatively quiet week in the market comes to a close, we thought we would step back from analyzing the market and briefly introduce to our readers a topic that we care greatly about and one that most of our readers are probably unfamiliar with. That topic is investments in intangible assets. The first question that probably comes to your mind after reading the previous sentence is...Why?

Simply, we here at GaveKal Capital believe that investments in intangible assets is what drives innovation in our global knowledge economy and intangible investments create massive reservoirs of wealth for companies that follow an innovation leading strategy that currently are being ignored by most of the financial community.

One of the first steps in understanding investments in intangible assets is frankly just recognizing what constitutes an intangible asset. An intangible asset is an asset that is not physical in nature. Because of this fact, investments in intangible assets have broadly been overlooked. There are three main categories of intangibles: 1) Computerized Information 2) Scientific and Creative Property 3) Economic Competencies.

Computerized information is the knowledge that is embedded in computer programs and computerized databases. Software programs and databases provide huge productivity gains for employees as they are able to leverage this technology. However, in order for these software programs and computer databases to be useful, most employees will need to undergo hours of initial training. Once these programs and databases are firmly in place within an organization, there needs to be a continuous reinvestment in time (learning the newest version and features, keeping a database up-to-date in order to keep the information useful) and money (buying the best hardware to compliment the software, upgrading software).

Scientific and creative property includes two main components: scientific R&D and non-scientific R&D. Scientific R&D is the most traditionally accepted and recognized form of intangible investment. For example, this is the type of R&D that a pharmaceutical company undertakes in order to create a new cholesterol drug. Scientific R&D is now included in the calculation of GDP for the United States as of last summer. It boosted the level of nominal GDP by about $500 billion so it is obviously not inconsequential. Scientific R&D, however, has a very specific definition of which fields that the R&D takes place in in order to be included in this category. Scientific R&D must take place in the math, natural sciences, and engineering fields. This means that R&D that takes place in things such as quality control, product testing and design, sales promotion effectiveness, and research in social sciences are not included. There is a separate category for these items and it is called non-scientific R&D. The latest research on intangibles actually estimates that spending on non-scientific R&D is about 2.5x greater than scientific R&D in the United States.

Last, but certainly not least, is the economic competency category. Economic competencies also include two sub-categories and account for the greatest share of intangible investments in the US economy. The two categories are: brand equity and firm-specific resources.

Brand equity is the knowledge and value embedded in brand awareness and recognition. Marketing and brand awareness have become extremely important as the global economy has flattened and customers and producers are increasingly located halfway around the world from one another. In order for companies to compete and gain market share in this type of a dispersed marketplace, consumers must be able to recognize and have positive associations with a company or products brand.

Firm-specific for all intents and purposes of this post is investments in worker training. The current knowledge economy is very much a service economy. As such, worker training becomes imperative as a companies workers become the primary way a consumer interacts with a companies brand or product. If the consumer has poor interaction with an employee, they may never come back to that company or product again.

Friday, June 20, 2014

European Biotech: Continued Outperformance

Members of the MSCI Europe Biotechnology sub-industry continue to outperform:

Valuations are not extremely compelling:

Relative to history, however, valuations have moderated for some members of the group:

Save the Date

GaveKal Capital will host a quarterly conference call on the GaveKal Knowledge Leaders Strategy. See below for details:

- Date: Thursday, July 24, 2014

- Time: 4:15pm ET for US investors

- RSVP for the call

- Add this event to your calendar

- www.gavekalcapital.com

- Email info@gavekal-usa.com for UCITS call details

Thursday, June 19, 2014

Have M&A Transactions Topped?

It feels like a new, meaningful merger or acquisition is announced daily-- mostly because companies have been busy making deals. And, while transaction volume has rebounded nicely from a recent low in early 2013, May's sharp drop in the value of transactions looks an awful lot like the one seen in June 2007 that preceded the gradual decline into 2008/2009 lows.

Certainly, one month's data does not guarantee a similar situation-- but it does bear watching.

Certainly, one month's data does not guarantee a similar situation-- but it does bear watching.

Volatility Continues To Grind Lower

Many investors, including ourselves, look at the CBOE VIX to measure market volatility. Over the past few days the VIX has made multi-year lows and is back at levels last seen in 2006-2007.

Another way that we look at volatility is by tracking the standard deviation of the daily price change in the market. What we see when we measure volatility using that metric is that volatility over the past 31-days is lower than at any point since 1996. Looking at it from a longer time-frame, over the past 252-days volatility is now at its lowest point since July 2007.

This lack of volatility seems to have made its way into volume statistics as well. As the charts below show, volume levels have fallen sharply since April as the percent of issues with their 50-day moving average of volume compared to their 1-year moving average, 3-year moving average and 5-year moving average have all steeply declined.

Another way that we look at volatility is by tracking the standard deviation of the daily price change in the market. What we see when we measure volatility using that metric is that volatility over the past 31-days is lower than at any point since 1996. Looking at it from a longer time-frame, over the past 252-days volatility is now at its lowest point since July 2007.

This lack of volatility seems to have made its way into volume statistics as well. As the charts below show, volume levels have fallen sharply since April as the percent of issues with their 50-day moving average of volume compared to their 1-year moving average, 3-year moving average and 5-year moving average have all steeply declined.

Wednesday, June 18, 2014

Stocks And Bonds Both Gain On Latest FOMC Meeting

The Federal Reserve kept to its taper program that has been in place throughout this year. Both bonds and stocks reacted positively to the news right on cue as the Fed announcement was released at 12pm MST.

The latest Fed projections were largely in line with March's projections outside of change in real GDP. Change in Real GDP for 2014 was lowered from a range of 2.8%-3.0% to 2.1%-2.3% due to much lower than expected output in the 1st quarter. The unemployment rate was also lowered slightly in 2014 and 2015. While the inflation forecast (using PCE inflation) was bumpbed up just slightly in 2014. This chart and the release can be found here

source: Federal Reserve

The latest Fed projections were largely in line with March's projections outside of change in real GDP. Change in Real GDP for 2014 was lowered from a range of 2.8%-3.0% to 2.1%-2.3% due to much lower than expected output in the 1st quarter. The unemployment rate was also lowered slightly in 2014 and 2015. While the inflation forecast (using PCE inflation) was bumpbed up just slightly in 2014. This chart and the release can be found here

source: Federal Reserve

European Apparel Retail: Inditex v. H&M

Over the last four years, analyst buy ratings in the MSCI Europe Apparel Retail sub-industry have hovered right around 50% for Inditex while those for H&M have expanded from ~15% to ~50% over the last year or so:

Inditex

H&M

In addition to similar analyst assessments, the valuations for these two rivals do not vary by much...

Each of the companies' investment profile includes spending ~10% of sales on intangible investments such as advertising...

Margins and returns are not dramatically different...

So, you may be wondering, are there any distinguishing characteristics between these two retail heavyweights? For us, the answer comes in the form of our point-and-figure charts. Designed to help us focus on the relative strength of each constituent versus the benchmark index, this methodology helps to identify useful trends and, most importantly, to avoid buying stocks with unfavorable technical profiles.

While H&M may be in an unexciting trading-range pattern, Inditex appears to be forming a top that will give way to a sustained downtrend sometime in the near future. It is important to remember that these charts are not meant to PREDICT a move in a stock's price but, rather, to help us better adapt to the manner in which that stock is behaving. In this case, Inditex would seem to be a much riskier bet-- in spite of incredibly similar fundamental assessments of these two companies.

Inditex

H&M

In addition to similar analyst assessments, the valuations for these two rivals do not vary by much...

Each of the companies' investment profile includes spending ~10% of sales on intangible investments such as advertising...

Margins and returns are not dramatically different...

So, you may be wondering, are there any distinguishing characteristics between these two retail heavyweights? For us, the answer comes in the form of our point-and-figure charts. Designed to help us focus on the relative strength of each constituent versus the benchmark index, this methodology helps to identify useful trends and, most importantly, to avoid buying stocks with unfavorable technical profiles.

While H&M may be in an unexciting trading-range pattern, Inditex appears to be forming a top that will give way to a sustained downtrend sometime in the near future. It is important to remember that these charts are not meant to PREDICT a move in a stock's price but, rather, to help us better adapt to the manner in which that stock is behaving. In this case, Inditex would seem to be a much riskier bet-- in spite of incredibly similar fundamental assessments of these two companies.

Average Stock Is 8% Off 252-Day High and 31% Above 252-Day Low

While the MSCI World Index is just a smidge off it's all-time high, the average stock is about 8% below it's 252-day high. Recent history suggests that we will need a slight consolidation, either through price or time, in order to make way for further gains. Over the past seven years, the lowest percentage the average stock has been from it's 252-day high is 6%. So the current reading is at somewhat extreme levels as the chart below shows.

Conversely, we have seen a divergence forming since May 2013 when looking at the average percent from 252-day lows and price of the MSCI World Index. The average price from the 252-day low has actually decreased from 52% to 31% over the past year while the market has rallied 200+ points. Strange...

Conversely, we have seen a divergence forming since May 2013 when looking at the average percent from 252-day lows and price of the MSCI World Index. The average price from the 252-day low has actually decreased from 52% to 31% over the past year while the market has rallied 200+ points. Strange...

Tuesday, June 17, 2014

Price To Book - 2008 to Now

It is easy to forget just how low valuations were in 2008 and how much they have expanded in the past six years. Below is a massive table showing the equal-weighted, average Price to Book ratio for 153 sub-industries in the MSCI World (we did not include the Renewable Electricity sub-industry because we did not have data that goes back to 2008)

Starting at the 30,000 foot view, the average price to book value for all sub-industries in 2008 was 2.3x. That has increased by 48% to 3.4x as of the end of May (this is a monthly data set). The MSCI World Index is up a little over 90% from the end of 2008 to May 2014. So a little over half of the gain can be attributed to margin expansion (looking at this single valuation statistic).

Within the sub-industries, there is a wide dispersion of multiple expansion changes. On the high end you have the Casino & Gaming sub-industry that has it's P/B ratio increase from 1.5x in 2008 to 11.8x (671% increase). Right behind it are the Department Stores where they have seen an increase of 405% (1.1x to 5.6x). Overall, just about a quarter of all sub-industries that have seen their valuations expand by over 100% since 2008 (37 sub-industries in all).

On the low end, we actually have 23 sub-industries that have seen multiples contract over the past six years. The leader of the losers is the Hotels Resorts & Cruise Lines. P/B multiples have contracted by nearly three quarters (72%) since 2008. However, the three largest contractors seem to have a base effect problem. 2009 looks to be the cycle low for them, not 2008, and when we calculate their change since 2009 their declines moderate significantly (and in the case of Metal & Glass Containers they actually have experienced a significant margin expansion).

Starting at the 30,000 foot view, the average price to book value for all sub-industries in 2008 was 2.3x. That has increased by 48% to 3.4x as of the end of May (this is a monthly data set). The MSCI World Index is up a little over 90% from the end of 2008 to May 2014. So a little over half of the gain can be attributed to margin expansion (looking at this single valuation statistic).

Within the sub-industries, there is a wide dispersion of multiple expansion changes. On the high end you have the Casino & Gaming sub-industry that has it's P/B ratio increase from 1.5x in 2008 to 11.8x (671% increase). Right behind it are the Department Stores where they have seen an increase of 405% (1.1x to 5.6x). Overall, just about a quarter of all sub-industries that have seen their valuations expand by over 100% since 2008 (37 sub-industries in all).

On the low end, we actually have 23 sub-industries that have seen multiples contract over the past six years. The leader of the losers is the Hotels Resorts & Cruise Lines. P/B multiples have contracted by nearly three quarters (72%) since 2008. However, the three largest contractors seem to have a base effect problem. 2009 looks to be the cycle low for them, not 2008, and when we calculate their change since 2009 their declines moderate significantly (and in the case of Metal & Glass Containers they actually have experienced a significant margin expansion).

Housing Starts Stuck At 1 Million

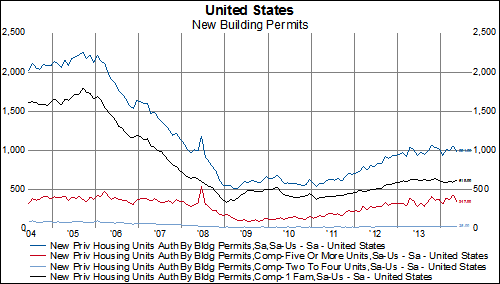

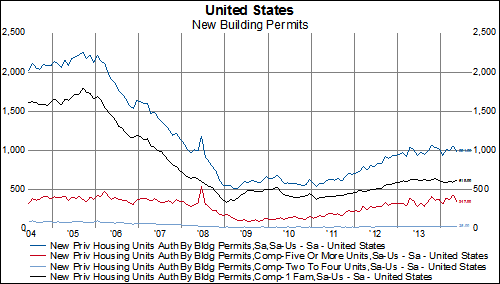

US housing starts for May came in below consensus at 1,001K units vs expectations of 1,036K units. Housing starts are still about 9.5% higher than they were a year ago. Regionally, housing starts are strongest in the Midwest while in the Northeast, starts are actually 5% lower than they were a year ago. Building permits were also below expectations in May (991K vs 1,062K expected). Charts below.

Germany ZEW Survey Continues to Disappoint

The ZEW Survey of economic expectations in Germany has fallen since the beginning of the year. As we have seen before (here), the current situation component remains benign while expectations for an improvement in the economy continue to decline.

For the first time this year, more participants are signaling the belief that inflation and long-term interest rates will decrease (black lines):

Expectations for a decline in the stock market have ticked up as well (black line):

If past correlations hold, German GDP would appear to have limited room for continued expansion:

For the first time this year, more participants are signaling the belief that inflation and long-term interest rates will decrease (black lines):

Expectations for a decline in the stock market have ticked up as well (black line):

If past correlations hold, German GDP would appear to have limited room for continued expansion:

Monday, June 16, 2014

Fewer and Fewer Gaps

The number of instances in which constituents of the MSCI World Index have experienced large price swings-- plus or minus 5% in either direction-- is approaching previously low levels that coincided with market declines:

Asia-Pacific

Europe

North America

Asia-Pacific

Europe

North America

Earnings Revisions Are Negative For A Majority Of Companies

60% of stocks in the MSCI World Index have experienced negative EPS revisions for the next fiscal year (FY1). Only two sectors, Financials and Information Technology, have at least half of their companies raising FY1 EPS estimates. While only 1 in 5 Telecom stocks and 1 in 4 Consumer Staples stocks have a had positive revisions over the past six months.

Sales revisions are slightly better. 46% of all stocks have seen their FY1 sales revised upwards and four sectors (Utilities, Health Care, Energy, IT) have at least half of their companies experiencing positive revisions. Consumer Staples again finds itself near the bottom of the barrel. 69% of all Consumer Staple stocks have had their sales revised downward over the past 6 months.

Energy stocks continue to have the highest growth hurdle rates over the next four years. On average, the Energy sector is expected to grow sales by 8.9% per year for the next four years and it is expected to grow EPS by 16.3% per year for the next four years. Put another way, Energy earnings are expected to almost DOUBLE in the next four years.

Sales revisions are slightly better. 46% of all stocks have seen their FY1 sales revised upwards and four sectors (Utilities, Health Care, Energy, IT) have at least half of their companies experiencing positive revisions. Consumer Staples again finds itself near the bottom of the barrel. 69% of all Consumer Staple stocks have had their sales revised downward over the past 6 months.

Energy stocks continue to have the highest growth hurdle rates over the next four years. On average, the Energy sector is expected to grow sales by 8.9% per year for the next four years and it is expected to grow EPS by 16.3% per year for the next four years. Put another way, Energy earnings are expected to almost DOUBLE in the next four years.