The growth in consumer confidence hasn't (at least for now) directly led into significantly stronger retail sales. Retail sales ended the year 3.2% higher, which is about a 1.5% lower than the average year-over-year growth rate since 1992. Core-Retail Sales (excluding Auto, Gas & Building Materials) has grown at an annualized rate of 4% over the past the quarter. It currently has downward momentum which could be a negative sign for S&P 500 returns.

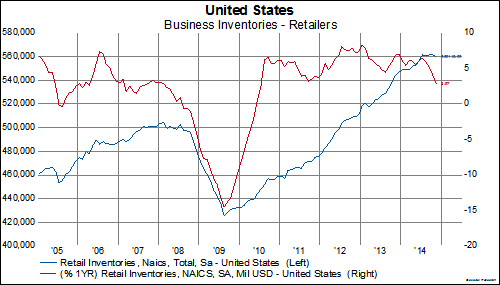

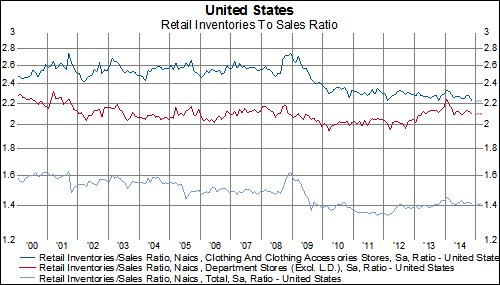

Given the increasing confidence the consumer showed throughout 2014, it is surprising to see inventories for retailers growing at its slowest speed since 2010. Retailer inventories have basically been unchanged since the summer. Also, inventories at department stores continues to fall. Department store inventories have steadily declined since 2009 after plunging in 2008. Even though inventories have been stagnant for half a year (in the case of retailers) or outright falling (in the case of department stores), inventory to sales ratios remained steady throughout 2014.

Perhaps the most striking (or surprising) stat we feel has gone unreported is the significant slowdown in consumer goods new orders. Consumer good new orders (through November) have declined by 3.6% year-over-year which is the lowest growth rate since October 2009. The year-over-year growth rate has been negative for the last four months. This is the first time that this has happened since 2009 as well.

Even though inventories and new orders seem seem to be indicating the consumer isn't quite as strong as the surveys suggest, stock performance for some selected US retail sub-industries indicate that perhaps the consumer is feeling stronger.

MSCI USA

Sales are expected to grow between 3.8% to 10.3% on average over the next four years. EPS, meanwhile, is expected to grow by 9.7% to 15.6% over the next four years. Those expectations, especially the EPS expectations, may be difficult hurdles to overcome. However, unlike the stock market aggregates, sales and EPS estimates haven't been cratering over the past three months which is a positive sign.

MSCI USA

MSCI USA

MSCI USA

MSCI USA

Unsurprisingly, these stocks are demanding very high relative valuations (except for department stores).

MSCI USA

MSCI USA

Overall, it is difficult to decipher whether the US consumer is strong or weak. Perhaps, the consumer is neither and continues to "muddle through" with the rest of the US economy. The consumer is undeniably feeling better according to recent surveys and stock performance of some retail sub-industries seem to validate those feelings. On the other hand, retailers don't look like they are preparing for a large spending binge as inventories are leveling out and new orders are falling.