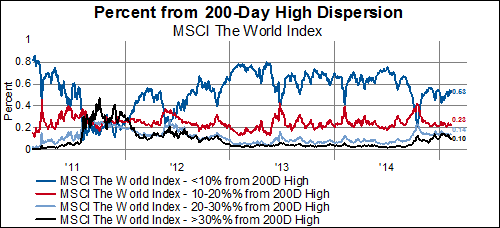

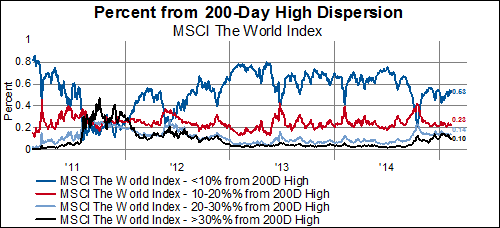

Regular readers know we like to slice the market internal data in a many different ways because a lot of the time the cap-weighted indices aren't a proper representation of what is going on with the majority of stocks. With this in mind, one of the ways we like to measure what is going on underneath the surface is to take a percentage of stocks that are trading at levels less than 10% off its 200-day high, 10-20% off its 200-day high, 20-30% off its 200-day high and greater than 30% off its 200-day high. By doing this, we get a good idea of what the price dispersion of stocks currently looks like. So while the MSCI World Index is basically at its all-time high, almost half of the 1600+ stocks are down 10% from its 200-day high (i.e. in a correction). Also,

almost 1/4 of all stocks are in a bear market and 10% of stocks are down at least 30%.