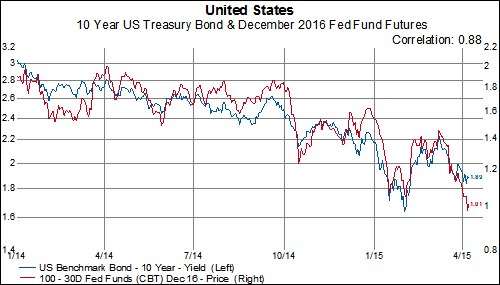

Unsurprisingly, 2016 fed funds rate expectations have fallen sharply as well. The market is now only pricing in a fed funds rate of 101 basis points by the end of 2016. This implies the market expects only 2 and half rate hikes in 2016. So we have gotten to the point where the market expects the fed funds rate to only be 20 basis points higher by the end of 2016 compared to where the market expected in September 2014 for the fed funds rate to be by the end of 2015. Rate hike expectations continue to be pushed back.