With Apple's (ticker: AAPL)

announcement that are selling more debt in order to buy back more shares and pay out dividends, a client posed an interesting question to us: Do you think Amazon (ticker: AMZN) will announce something similar soon? Our short answer is most likely no since Amazon tends to reinvest earnings, especially in intangible investments, much more aggressively than Apple does. Let's take a quick look at how Amazon and Apple's investment profiles and payout strategies differ (all data refers to

Gavekal's intangible-adjusted financial statements).

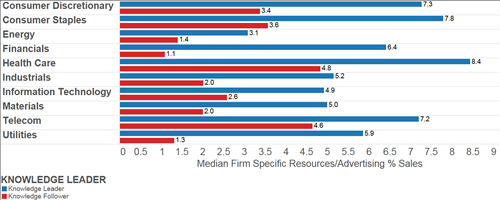

Amazon spends about twice as much of their sales on total capital investment than Apple. Amazon spends nearly 20% of its sales on capital investment while Apple spends about 11%. This difference in investment rates is almost entirely due to intangible investments. Amazon spends 5.5% of its sales on tangible fixed investment. Apple spends 5.4% of its sales on tangible fixed investment. However, Amazon spends nearly 10% of its sales on research and development (R&D) a rate that is nearly 3x as much as Apple spends (3.3% of sales). Amazon also spends over twice as much on other

intangible investments such as firm specific resources (i.e. employee training, codified information, etc) and advertising. Amazon spends 4.4% of its sales on other intangible investments while Apple spends 2% of its sales.

Given these investment profiles, it is not surprising to see that Amazon has a much higher level of intellectual property assets on its balance sheet than Apple (31% of assets vs 8% of assets). When we look at several balance sheet ratios, we can see how Apple has added leverage in order to return capital to investors through buybacks and dividends. Apple has about 8% of its asset in property, plant and equipment which is financed using long-term debt. However, over 18% of its capital is in long-term debt. Meanwhile, Amazon has nearly 21% of its assets in property, plant and equipment but only has 25.8% of its capital in long-term debt. Lastly Amazon also has a much greater portion of its capital in cash (36%) than Apple does (16%). This makes complete sense since Amazon invests heavily in intangible assets and we know that intangible investments are

equity financed.

Historically neither Amazon or Apple have been focused on returning capital to shareholders. Steve Jobs was famously against returning capital to investors through dividends because he preferred the flexibility of having tremendous amounts of cash on hand. In February 2010 he responding to a question about why Apple doesn't pay dividends like

this:

"We know if we need to acquire something -- a piece of the puzzle to make something big and bold -- we can write a check for it and not borrow a lot of money and put our whole company at risk. The cash in the bank gives us tremendous security and flexibility."

However, Apple under Tim Cook's leadership has changed course on this belief and now uses nearly 2/3 of its operating cash flow for stock buybacks and 17% of its operating cash flow for dividends. Amazon, on the other hand, doesn't pay out any dividends and occasionally buys back shares but hasn't for the past several years.

Dividends as a % of Operating Cash Flow - Apple

Share Buybacks as a % of Operating Cash Flow - Apple

Share Buybacks as a % of Operating Cash Flow - Apple

Dividends as a % of Operating Cash Flow - Amazon

Dividends as a % of Operating Cash Flow - Amazon

Share Buybacks as a % of Operating Cash Flow - Amazon

Share Buybacks as a % of Operating Cash Flow - Amazon

Overall, you can see in the data that Amazon and Apple have very different strategies when it comes to what to do with operating earnings. Amazon is constantly reinvesting, which can lead to

disappointing quarterly earnings if you don't adjust for intangibles, while Apple has moved to a much more investor-friendly strategy in recent years. One thing to keep an eye on for Apple is if by choosing to increase shareholder distributions rather than increasing investment will this lead to lower growth in the future. There are early indications that this may be happening. Growth in sales per share, EPS, BV per share, and cash flow per share has averaged an astonishing 36% or more per year over the past 10 years. However, over the past three years growth in these metrics has slowed to a more pedestrian (but still impressive) 20% growth rate as the amount distributed to shareholders has increased. We acknowledge there might be other factors other than just simply investment rates (such as the sheer size of Apple now versus 10 years ago) but it is something to keep an eye on nonetheless.

3-Year Least Squared Growth Rate

10-Year Least Squared Growth Rate

10-Year Least Squared Growth Rate