Amazon has been squarely focused on expanding over the past few years and we would argue they have been very successful as they have realized a least squares sales growth rate of 31% annually over the past five years. In order for this growth to take place, they have significantly increased both their tangible investments (i.e. more warehouses closer to more consumers to reduce shipping time) as well as intangible investments (i.e. developing new products such as the FireTV, Fire phone, unlimited kindle subscription service, and introducing Sunday delivery to 15 US cities). We can see this increased focus on long-term investing clearly in their financial statements:

Capex as a % of Sales - Current level is 3x what it was in 2007

R&D as a % of Sales - Current level is 2x what it was in 2009

Firm Specific Resources as a % of Sales - Other intangible investments have also been increasing

You can also see their long-term focus show up on their balance sheet. Intangible-adjusted long-term assets as a % of sales have increased from around 34% in 2007 to 49.9% currently.

Both traditional and intangible assets have increased as a percent of total assets as well.

Intangible-Adjusted Property, Plant & Equipment as a % of Assets

Intangible-Adjusted Intellectual Property as a % of Assets

They have paid for these investments by slightly increasing their long-term debt over the past few years as well as using up some of their cash on their balance sheet. Overall though, Amazon continues to have a very liquid balance sheet.

Intangible-Adjusted Long-Term Debt as a % of Capital

Intangible-Adjusted Cash as a % of Capital

Now we can see how much these long-term investments affect Amazon's bottom line from a traditional accounting standpoint that treats intangibles investments as current expenses rather than as an capitalized long-term asset that depreciates over time like a tangible investment. In this next section we are going to toggle back and forth from "as reported" data to "intangible-adjusted" data to clearly highlight the effects of the differences in accounting treatments.

Amazon's gross margin has actually been on the rise over the past few years.

However, their as reported net margin is pitiful at 0.4%. However, when intangibles are properly capitalized it rises to a much more respectable 8.4%.

Amazon's operating cash flow as a % of sales is 7.4% using reported data. However, their intangible-adjusted OCF as a % of sales increases to over 21%.

All of their profitability ratios change dramatically for the better when intangibles are properly capitalized as well.

ROA increased from 0.7% to 10.5%

ROE increases from 2.8% to 21.9%

And ROIC increases from 1.8% to 18.6%

Finally, let's take a look at how different valuations look for Amazon from an intangible perspective.

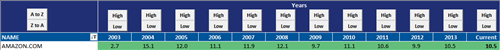

From a Price to Sales perspective, and of course sales don't change whether or not you are using an intangible accounting treatment, Amazon is trading slightly below it's 10-year average of 2.3. It currently sits at 2x sales.

However, from a Price to Cash Flow and obviously a Price to Earnings perspective, Amazon looks much less expensive from intangible point of view. Amazon's reported P/E ratio is above 100x (we cap our data tables at 100x to limit outlier effects in our aggregate data series. 100x is preposterous enough and anything greater than that is simply noise in the data), however, Amazon is trading at a more respectable, if not still rich 24x P/E ratio from an intangible-adjusted perspective.

And the same story holds when looking at P/CF. As reported it stands at very high 27.9x cash flow but the intangible-adjusted ratio is only at 9.6x.

All in all, you can see that for a company that is focused more on delivery superior long-term growth than short-term accounting profits, proper accounting treatment of intangible assets is incredibly important in understanding the true nature of a firm.