Friday, October 25, 2013

KDDI Gets Clobbered as Nikkei Plunges 2.75%

The Nikkei had the pre-FOMC jitters last night finishing down 2.75% to close at the medium-term rising trendine. KDDI took it on the chin as the worst performing stock on the day, finishing down 5.3% on bets it will loose market share to NTT DoCoMo as the latter ramps up incentives to gain users. The positive price movement in KDDI we've seen so far this year is in serous question now.

German Ifo Business Climate Survey

Today's disappointing Ifo Business Climate Survey was lead by a general drop in the assessment of the Services Sector and, in particular, a sharp fall in the expectations component:

The overall moderation does not, however, appear to bode poorly for the upcoming release of economic output in the third quarter:

The overall moderation does not, however, appear to bode poorly for the upcoming release of economic output in the third quarter:

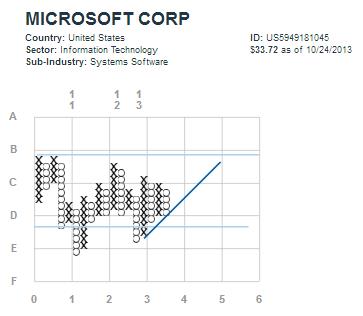

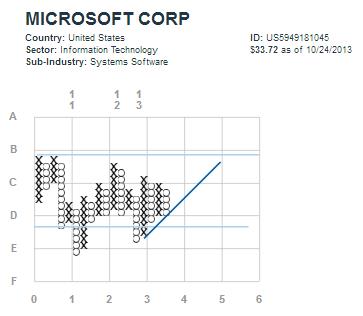

Microsoft and CA Inc both beat 3Q expectations

In our quarterly call yesterday, "Investing in a Post QE World" (here is a link to a video of the presentation), we highlighted the systems software industry as one where value is still compelling and many of the companies in that industry are very shareholder friendly. In particular, we highlighted Microsoft and CA Inc. Well as if on cue (we wished all of our ideas worked so neatly!), Microsoft and CA Inc both reported earnings that beat analyst expectations. Microsoft reported EPS of $0.62 while analysts were expecting it to come in around $0.54. Meanwhile, CA Inc reported EPS of $0.53 versus expectations of $0.41. Microsoft is up about 5.5% so far today and CA Inc is up nearly 4%.

Thursday, October 24, 2013

Usefulness of Shiller P/E

We received a question today regarding the usefulness of the Shiller P/E. For starters, it has a wonderful long-term history. There aren’t many series where we have 130 years of history.

Using the Shiller P/E makes us ask ourselves a very simple

question when we attempt to value stocks: are current earnings a good

representation of the long-term earnings capacity of stocks?

That forces us to consider the prevailing level of profit

margins. Today they are quite a bit above the long-term average, and

historically that has been a good leading indicator for negative profit growth. If there is any mean reverting tendency to margins, the

current level of profit margins suggest annual earnings growth of -10% for the

next 4 years.

To be precise, current profit margins—using the latest NIPA

data—are 57% above the long-term average.

So, what got margins to these levels to begin with, and what

could that tell us about the projected future path?

Let’s start with the idea that margins are a form of savings

(for the corporate sector), similar to the household savings rate (for

household sector) or budget deficit (savings, or dis-savings as is the case,

for the government sector). Savings in one sector has its reflection in

the savings or dis-savings of the other sectors. So, when we think about

margins, we are thinking about the interplay between the savings of these three

sectors.

Savings by the corporate sector has a reflection in the

savings of the household sector and government sector. For the decade

prior to 2001, it was fairly normal for the combined savings of the household

sector and government sector (household savings rate + budget deficit as a % of

GDP) to run around +5%. In this environment margins trended between 5-7%.

Beginning in 2001, the sum of government and household

savings began to decline. Both the household sector and government sector

reduced their savings rates, down to the point that the combined sum was zero

in the years leading up to the financial crisis. In this environment,

profit margins (corporate savings) drifted up to over 8%. So, margins

achieved record heights as the combined sum of the private and government

sector was zero.

As the financial crisis took hold and government sector

enacted a set of policies to further dis-save, the combined household and

government savings rate fell to almost -5% of GDP. In this backdrop,

margins surged to levels never seen in post war history.

The combined sum of household and government savings has

just crossed back over the zero threshold, offering us a great insight into the

likely course of margins in the years to come.

We can probably take for granted continued reductions in the

budget deficit in the years to come, so it all comes down to the

consumer. If the household sector chooses to run down its savings rate in

the years to come, margins probably hold pretty firm. If the household

sector instead chooses to hold or increase its savings rate, then it seems

quite likely margins will face a headwind. The future course of

taxes will probably figure into households decision.

Margins have already contracted for five quarters (as budget

deficits shrink), with margins having peaked in the fourth quarter of 2011.

So, going back to our original question of whether current

earnings are a good representation of long-term earnings capacity, my answer is

“not likely”. The last few years are a pretty unique period in history,

with record household+government dis-saving reflected as record profit margins.

If we margin adjust the Shiller P/E incorporating profit

margins that are 57% above the long-term average, we calculate a P/E of around

33.5x. To put this in historic context, at the peak of the tech

bubble in 2000, we hit 40x earnings on this metrics, and in 2007 we hit 35.5x. At the low in 1982, as margins were below average, we hit

5.8x. If the post WW2 average Shiller P/E is just under 19x, we

are around 80% above that level currently.

We think in the end, the key to the Shiller P/E is how it

used. It is an invaluable tool that helps us ask the right

questions.

European Economic Policy Uncertainty

With headlines like 'Plans for Political Union Unravel' (WSJ) and 'Draghi's Blunt Warning on Bank Stress Test' (FT), policy (or, rather, lack of a coordinated one) appears poised to exert its influence on European equities once again:

Combined with somewhat weaker economic and sentiment-related data releases, as well as overbought and extended technical patterns, can European stocks continue to move higher?

Combined with somewhat weaker economic and sentiment-related data releases, as well as overbought and extended technical patterns, can European stocks continue to move higher?

A Not So Random Walk in 2013

Everyone that's read Burton Malkiel's A Random Walk Down Wall Street learns the idea that the movement of stocks is random--they can rise or fall on any given day. Like a hitter in baseball or a shooter in basketball, players can go on "runs" that temporarily give the appearance of non-randomness. Similarly, stocks can do the same, and for a period of time violate the random walk. This is currently the case, and has in fact, been the case all year.

We measure the number of days a stock has been up and down over the previous 88 trading days (4 months). A perfectly random walk would have a stock up 50% of the says and down 50% of the days. We can also perform the exercise on stock indices. Currently, using the S&P 500 index, stocks have been up 66% of the trailing 88 days. Moreover, the percent of days up has been above 50% all year long, which is a first since the Lehman induced financial crisis of 2008.

This looks less like a random walk than a manufactured sprint, engineered by massive amounts of quantitative easing. In sports, the payback from a "run" is a "slump".

We measure the number of days a stock has been up and down over the previous 88 trading days (4 months). A perfectly random walk would have a stock up 50% of the says and down 50% of the days. We can also perform the exercise on stock indices. Currently, using the S&P 500 index, stocks have been up 66% of the trailing 88 days. Moreover, the percent of days up has been above 50% all year long, which is a first since the Lehman induced financial crisis of 2008.

This looks less like a random walk than a manufactured sprint, engineered by massive amounts of quantitative easing. In sports, the payback from a "run" is a "slump".

China's Flash Manufacturing PMI Signals Further Expansion in October

China's flash manufacturing PMI came in at 50.9 in October vs the official reading of 50.2 in September. Readings above 50 signal expansion. The rise was mostly driven by the backlog of work and employment components (though the employment component remains below 50), but new export orders registered a small gain as well. We expect the pace of gains in the PMI to moderate or even reverse in the months ahead as the government reins in credit growth.

Rally Like It's 2009

We perform a variety of calculations to understand the often imperceptible changes in the underlying structure of the stock market. One calculation we make is to measure the percent of stocks making a new 200-day high. Historically this metric gets the most extended during the first move off a major low--like in September 2009. Often, peaks in this metric (readings over 15%) are associated with intermediate peaks in stocks. On Monday, 18% of the MSCI World index (over 1,600 companies total) made new 200 day highs, just short of the 19% reading on September 18, 2009--after stocks were up 70% from March 2009 lows.

Xerox is taking a beating so far today but the stock still looks good

Xerox guided down 4Q EPS from continuing operations estimates to $0.28-$0.30 per share

which was below the $0.33 analysts' were expecting (they did manage to slightly beat expectations for the 3Q, however). Basically, the entire

discrepancy is a charge of $0.04 for restructuring its outsourcing business.

They kicked off this restructuring plan for their services business last November.

It is little surprising to see XRX getting whacked as hard as it is today but it may be due to

the fact that it has been on a good run and has outperformed by 5% and 28% over

the past 3 and 12 months, respectively. The point and figure chart still looks

ok.

JOLTS and Initial Claims data add to employment slowdown fears

The level of job openings has now been been basically unchanged since February.

The job openings data may be signalling a stalling out of employment.

Initial jobless claims fell by 12k but the prior week was revised up by 4k. More concerning is the four-week moving average is now over 40k higher than it was in September.

The job openings data may be signalling a stalling out of employment.

Initial jobless claims fell by 12k but the prior week was revised up by 4k. More concerning is the four-week moving average is now over 40k higher than it was in September.

Wednesday, October 23, 2013

Global Consumer Price Inflation Still Trending Lower in September

In the below charts we take the average YoY% change in consumer prices for 33 countries around the world. What we see is a trend of disinflation that started in mid-2011 and continued through September. This might help explain the weakness we've seen in gold over the last year, though the big divergence in Global CPIs and the MSCI World Index has us perplexed. In any case, we'd like to see prices become a bit firmer from here, and we are sure the Fed would too.

Employment in the US & Stock Valuations

For the last 40 years, the employment to population ratio has been well correlated with equity valuations.

As would make sense, when more people are working, income is higher, demand is more sustainable and investors rationally capitalize corporate earnings at a higher rates. When employment rates are low, the opposite happens. By this crude measure, stock valuations Should more appropriately be in the 10-15x range, rather than the 20-25x range.

As would make sense, when more people are working, income is higher, demand is more sustainable and investors rationally capitalize corporate earnings at a higher rates. When employment rates are low, the opposite happens. By this crude measure, stock valuations Should more appropriately be in the 10-15x range, rather than the 20-25x range.

Shadow Banking Credit Contraction and the S&P 500

So far the contraction in commercial paper has not had a negative impact on stocks, but history would suggest that this is a red flag.

High Valuation Semiconductor Stocks Get Hit

The semiconductor/semi-cap equipment industry is taking a hit today, with Altera and Cree leading the way down.

These are two of the more expensive stocks in the industry, looking at price/cash flow.

These are two of the more expensive stocks in the industry, looking at price/cash flow.

NYSE Margin Debt rose to All-Time highs

Peaks in NYSE Margin Debt has been a leading indicator in the last large market declines (2000, 2007, 2011). NYSE Margin Debt was looking like it might be topping out in April. However, the latest data for September shows it increased by about $20 billion to new all-time highs.

US import prices ex-petroleum remain negative on a year-over-year % basis

US import prices ex-petroleum fell further on a year-over-year basis. This series has now been negative since March. The movements in the USD do not suggest this deflationary pulse from import prices will be abating over the next few months.

Tuesday, October 22, 2013

Credit Impulse From QE Fading

A good proxy for the expansion and/or contraction of the shadow banking market is the change in the amount of commercial paper outstanding. Successive rounds of QE--represented by the expansion of the Federal Reserve's balance sheet--have had a stimulative, but short lasting impact on the expansion of shadow banking credit. Below we show the 3-month change in the Fed's balance sheet alongside the amount of commercial paper outstanding. The amount of commercial paper outstanding has dropped by $100 billion since the third week in May (when we first heard the word "taper"). From this perspective, the shadow banking system is now exerting a negative credit impulse into the US economy.

The most interesting charts from today's (delayed) US Employment Report

Our favorite statistic to look at whenever the monthly employment reports rolls around is actually 3 statistics multiplied together. We take Payroll Employment x Average Weekly Hours x Average Hourly Earnings to come up with a "National Income Proxy". It's indicating 3Q GDP growth will remain within the range that it has been in since the recovery began.

The US Manufacturing Renaissance theme that is very popular is not yet showing up in the employment.

The participation rate was unchanged from the month before. That also means it continues to be at its lowest level since 1978.

One positive is the number of people who have been unemployed for the longest amount of time continues to decline.

State and Local Government's are hiring again. And based on tax revenues, this trend looks like it will continue.

The US Manufacturing Renaissance theme that is very popular is not yet showing up in the employment.

The participation rate was unchanged from the month before. That also means it continues to be at its lowest level since 1978.

One positive is the number of people who have been unemployed for the longest amount of time continues to decline.

State and Local Government's are hiring again. And based on tax revenues, this trend looks like it will continue.

Treasuries Yields Slammed Lower as Safe Havens Catch Bid

10 year treasury yields finished 9bps lower on the day today hitting the lowest level since mid-July while gold, silver, copper and the euro all caught a decent bid. The divergence between S&P 500 futures and the 10 year note is now at the most extreme in a month.

Subscribe to RSS

Posts (Atom)