If we had been on a deserted island in the south Pacific for the past month and a half with no cell service or internet access (doesn't sound so bad!) and upon our return we knew only that that US stocks had dropped nearly 10% and then rallied back to make an all-time high, we would have guessed a few things:

- A substantial v-shaped rally in such a short period of time must have been driven by cyclical stocks

- The areas of the market that were beaten down the most during the decline (EM, small caps. Europe) would surely have outperformed

- World stocks as measured by the MSCI World Index must also be near an all-time high

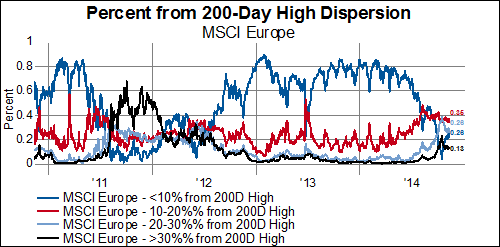

- Following number three, an increasing number of individual world stocks would be at 200-day highs

- Government bonds would have massively sold off off of the equity market lows

- Inflation expectations would have recovered all of their decline

- High yield bond spreads would have confirmed the new highs in stocks

- Commodities would have rallied off of the equity market lows

- The USD would have gone down off of the equity market lows

Sadly, we would have been wrong about all of these things (as the charts below show), which is what makes this particular rally all that much more perplexing. Indeed, with such a powerful thrust in US stocks we would have expected a rather obvious cyclical/reflationary tilt to this rally, but we've gotten exactly the opposite. This has us scratching our heads and approaching our next moves with caution. Charts below.

1) Counter cyclical stocks continue to outperform cyclical stocks:

2) EMs, Europe, and to a lesser extent small caps continue to underperform the S&P500:

3) The MSCI World Index has broken its upward sloping trend line, has made a series of lower lows, and has formed a dead cross:

4) The number of world stocks at new highs continues to make lower highs:

5) Government bond yields have barely budged higher and the trend lower remains firmly intact:

6) Inflation expectations have recovered a bit, but remain near the lows:

7) High yield bond spreads narrowed off the highs, but are still divergent from stocks and are in a clear widening trend:

8) Commodities continue to struggle:

9) The USD has shot higher: