After a somewhat weak industrial production data release, we thought we would review what is-- and isn't-- working in the MSCI Germany Industrial sector.

Overall, the average Germany Industrial company's stock has actually

not performed poorly over the last month, leading all sectors (with the exception of Utilities where both constituents outperformed on buyout/ upgrade news):

More than half of the MSCI Germany Industrial sub-industries have outperformed the MSCI World over the last month:

The Industrial Conglomerates' underperformance can be traced to downgrades of Siemens, in spite of the company beating earnings expectations:

On an absolute basis, Siemens appears to be turning back down from resistance established in 2011-- the question is whether the bullish support line will hold, allowing for another attempt at a breakout:

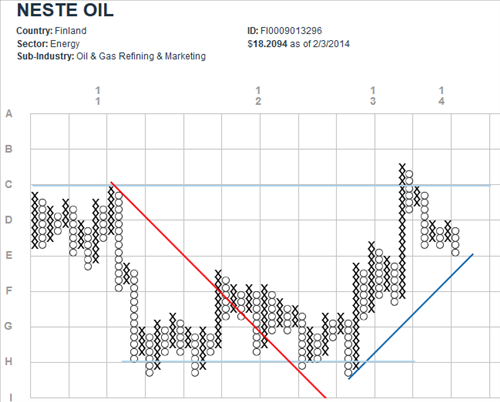

When we look at the point-and-figure chart on a relative basis, however, the stock appears to be breaking out from a solid base and defying the downtrend line:

Turning to the most positive performer in the MSCI Germany Industrial sector, we have Lufthansa-- which is breaking out above long-term resistance on a absolute price basis:

Versus the MSCI World, we see a picture with a lot more resistance: