We divide all stocks into baskets in an attempt to understand market internals. All stocks are divided into four groups: 1) early cyclicals, late cyclicals, hyper-cyclicals and counter-cyclicals. The early-cyclical basket is comprised of consumer discretionary stocks, while the late cyclical basket is comprised of industrial and material stocks. Generally, as a fed tightening cycle begins, early-cyclicals underperform late cyclicals. In the chart below we map the relative performance of early-cyclicals vs. late cyclicals, alongside the 3-month increase in the Fed's balance sheet. As the Fed expanded its balance sheet over the last few years, early-cyclicals outperformed, but since early March they have significantly underperformed.

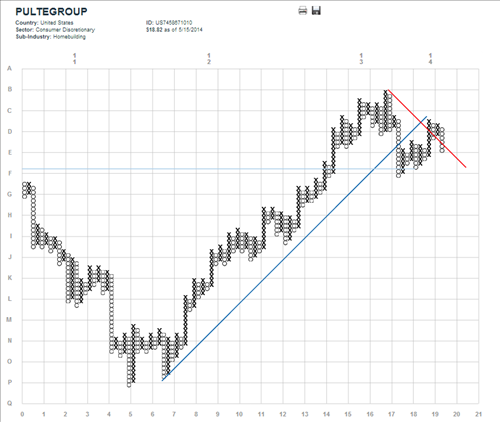

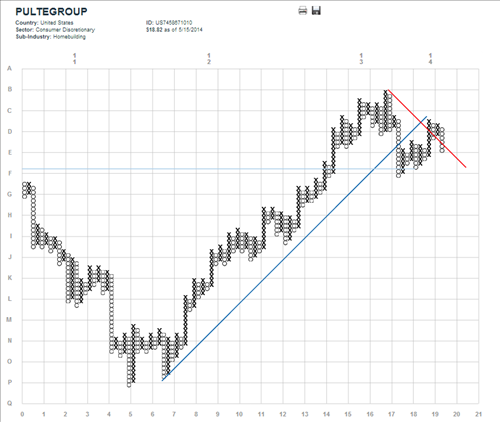

The homebuilders are great example of the rotation out of early cyclicals. Below is our point-and-figure chart of PulteGroup that tracks relative performance compared to the MSCI World index. After a strong run, off the lows of 2011, PulteGroup has broken the uptrend line and appears to have entered a new downtrend compared to the MSCI World index.