Country Allocation of Gavekal Knowledge Leaders Developed World Index (KNLG)

Because of our structural emphasis on Japan, we spend a good portion of time sifting through Japanese stock ideas. In Japan there is no shortage of statistically cheap companies. In the tables below we show Japanese constituents of our KNLG index that are under 5x intangible adjusted cash flow. We deduct from current period income all the intangible investments that companies make (like research and development, employee training or advertising) in order to arrive at our measure of intangible adjusted cash flow.

KNLG Japanese Consumer Discretionary

KNLG Japanese Consumer Staples

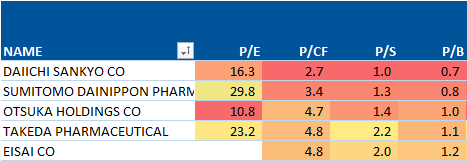

KNLG Japanese Health Care

KNLG Japanese Industrials

KNLG Japanese Technology

KNLG Japanese Materials