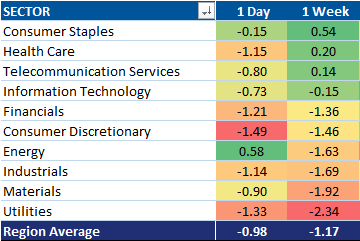

While European cyclicals had a brief window of outperformance, leadership trends appear to be reverting back to counter-cyclical leadership as we speculated in Long-Term Relative Performance Trends in Europe. Over the last week, consumer staple companies have led European performance, while health care and telecom have followed closely behind. In USD terms, these are the only three sectors with positive performance since Euro QE has begun.

MSCI Europe Sector Performance in USD

Over the last five years European counter-cyclicals have outperformed cylclical sectors by 28% cumulative. As the chart below illustrates, at the end of January, the relative performance of European counter-cyclicals vs. cyclicals broke out to hew highs. We have had a minor pullback, but given the move in German rates, we maintain that counter-cyclicals will continue continue to outperform cyclicals in Europe.

Of particular interest, should German rates continue to fall, are growth counter-cyclical stocks--those in the consumer staple and health care sectors. The plunge in German rates over the last years from 2% to 20bps has provided a lot of fuel for another big leg of growth counter-cyclical outperformance.