As the U.S. Dollar takes a breather from its surge upward since the middle of last year...

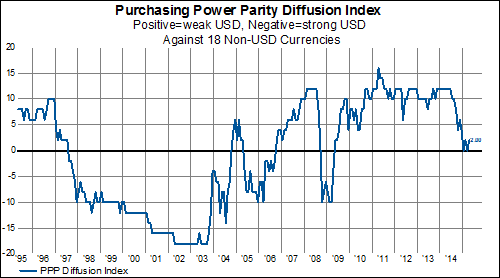

And our diffusion index of purchasing power parities versus 18 other currencies hovers in neutral territory...

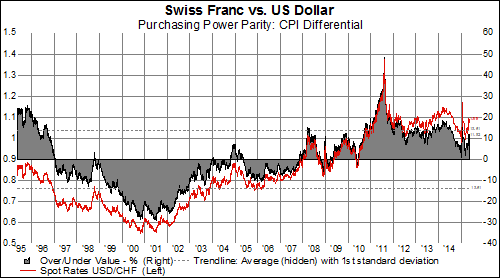

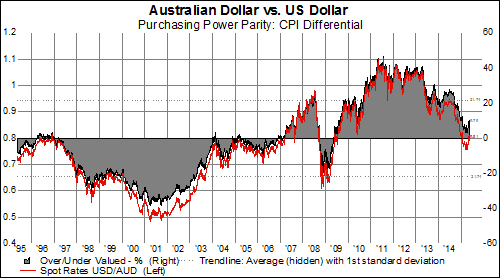

While individual PPP trends shift ever so slightly...

Europe

Asia

North America

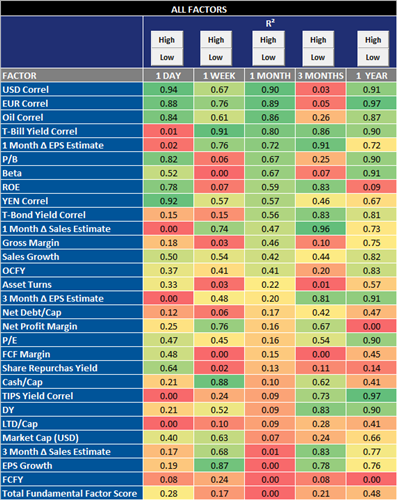

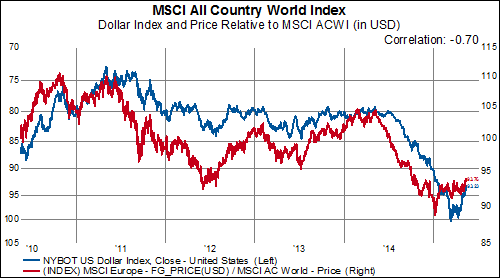

Correlation with the USD has been the single most important factor in equity performance throughout the world over the last month:

If the relative importance of the correlation to the USD persists, this has noteworthy implications for various regions around the world. North American equities, which tend to outperform during periods of USD strength, have languished in the face of a weaker dollar. Meanwhile, Europe and EMEA--with the strongest negative correlations to USD performance-- could benefit from a pullback or further consolidation.

North America

Europe

Pacific

Latin America

EMEA

EM Asia