FY1 sales estimates had already dropped by -2.4% over the past six months, however, FY1 EPS had actually increased by 2.2% over the past six months.

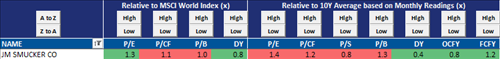

JM Smucker pays a pretty nice dividend of 2.1%. However, it has been trading at some rich valuations levels relative to the rest of MSCI World as well as relative to it's own history.

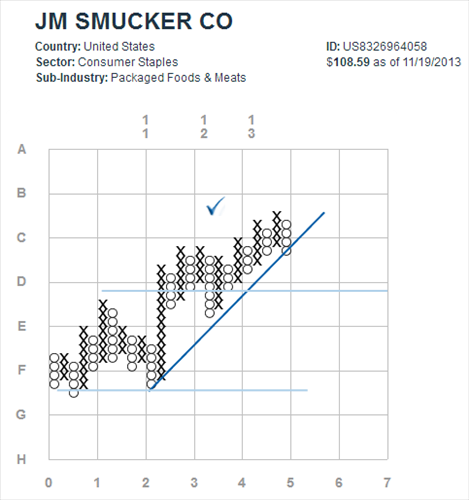

Overall, the stock has been losing momentum shown by the decline in the average daily price change. If today's decline holds the stock will have broken an uptrend support line.