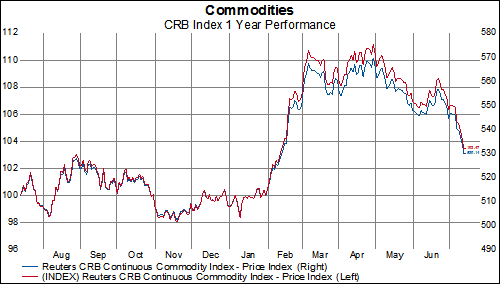

Our 12-month commodity diffusion index tracks 20 different commodities and measures whether or not prices are higher or lower than they were a year ago. At the beginning of the year, 15 commodities were lower and only 5 were higher than the previous year so the net diffusion index stood at -10 (we score our diffusion index by using a +1, -1 system where, in this case, if the commodity is higher than it was it scores a +1 and if the commodity is lower than it was it scores a -1. We add them all together to get the diffusion index level). At the end of June, this had to a net score of +6 (13 were higher and 7 were lower). This is a positive development for emerging market currencies as they have had a pretty tight relationship to changes in commodity prices.

We also have an emerging market diffusion index that tracks 9 currencies against the dollar using the same methodology as we explained above (in this case if the currency is stronger against the dollar it scores a 1 and if it is weaker against the dollar it scores a -1). The emerging market currency diffusion index has moved from a -7 net score in April to a -3 net score in June as breadth in commodity prices has improved.