Though the group may have reached oversold territory, we can hear the voice of a long-time mentor whispering, "there is no such thing as TOO cheap."

Energy constituents spend the least on R&D and Advertising as a percent of sales, resulting in one of the lowest stocks of Intellectual Property of any sector:

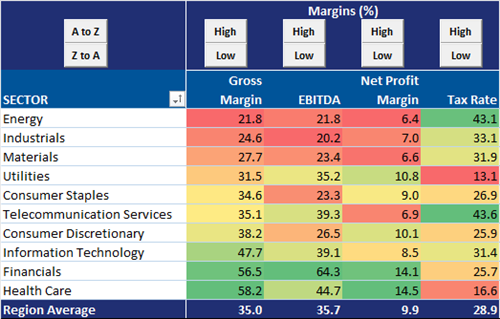

European Energy companies have the lowest margins and nearly non-existent free cash flow:

Earnings estimates seem to reflect these fundamental shortcomings fairly well:

Finally, among the 24 constituents of the MSCI Europe Energy sector, we can find just ONE chart in our point-and-figure methodology that looks even remotely hopeful:

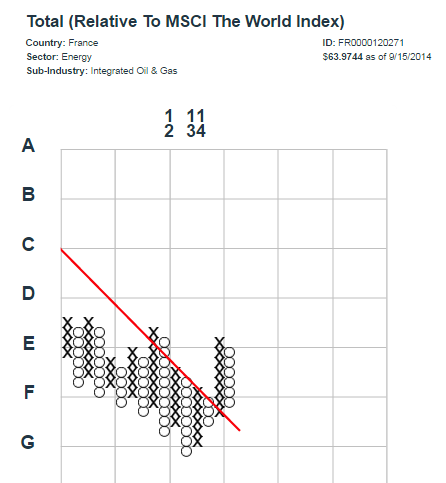

The rest look something like this:

It could be some time yet before this particular group offers many promising investment opportunities.