An article in the Financial Times (subscribers, see

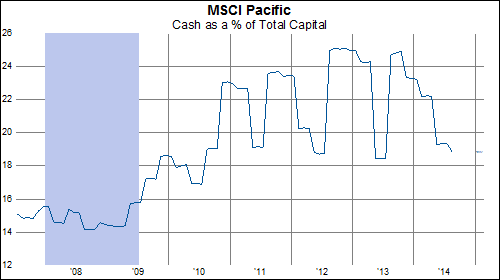

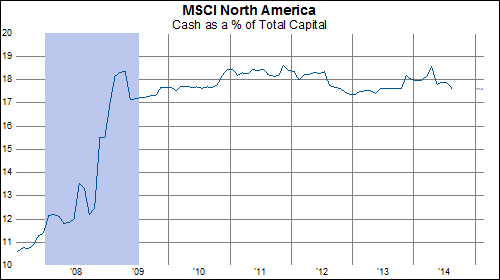

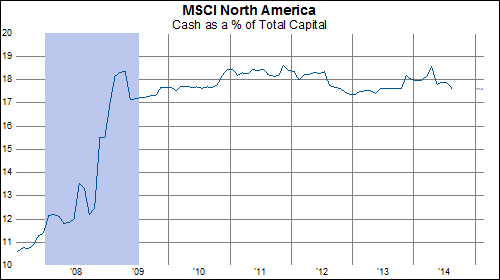

here) prompted us to ask ourselves, 'Really??' and take a high level look at cash (and debt) levels in the various regions of the MSCI World. Compared to the Asia-Pacific and North American regions, the trend in cash as a percent of total capital is actually not so great for European companies, on average:

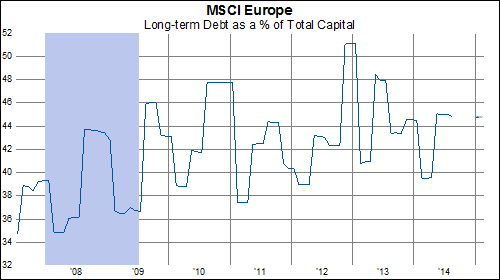

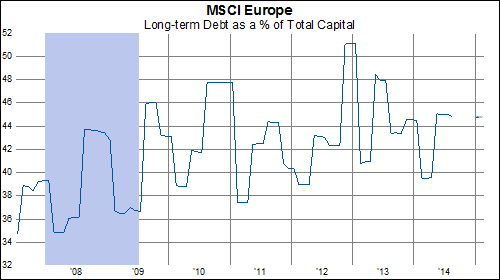

Similarly, the trend for debt among constituents of MSCI Europe is less encouraging than that in the other regions:

Sure, individual companies have made progress in strengthening cash cushions on their balance sheets. On the whole, however, it seems that European companies have more work to do here.