The highest yields can be found in the Energy, Utilities, and Telecom sectors:

More companies in Consumer Discretionary, Energy, and Consumer Staples are raising their dividends compared to their peers in other sectors:

The percentage of companies in MSCI Europe that are raising their dividend has increased, on average, in the last few years, led by consumer and commodity focused sectors:

Given the above-noted sectoral trends, the sub-industries that offer the highest yields are no surprise:

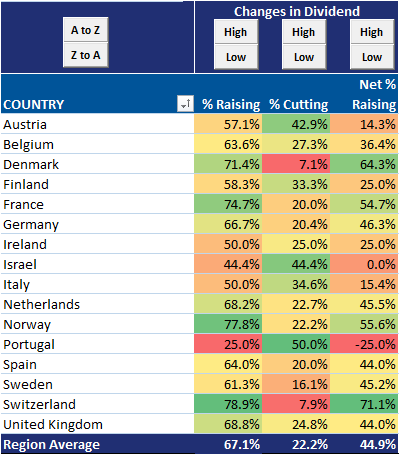

By country, more companies in Switzerland, Denmark, and Norway are raising dividends, while the highest yields can be found in constituents from Israel, Finland, and the U.K.:

Will investors' search for income have a positive effect on the dismal performance of the higher dividend paying Energy sector?

That remains to be seen, of course-- but we have a feeling it will take more than attractive dividends to arrest the significant declines that we discussed here last week.