Interviewer: On the whole, what does your research suggest of where we are in the overall commodities cycle? And what implications does this have for major producers, such as Australia, Canada and many emerging markets?

Dr. Jack: It suggests that the boom years of the past decade and a half were the exception and not the rule. Australia and Canada will have a bit of rough patch in the years to come, but will manage through as they always do. The much touted growth prospects of many of the BRICs will prove to be nothing more than a commodity-boom-fuelled mirage.

In the charts below, we can see where he is coming from. We compare the MSCI Emerging Market Price Index to the CRB index and copper prices. In both cases the correlations are quite high, at 93% and 96% respectively.

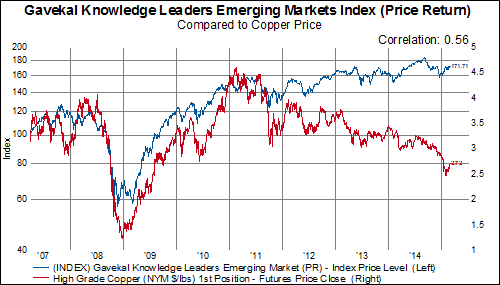

Is there a better investment approach to investing in the emerging markets? Yes, in the chart below we show the performance of our Gavekal Knowledge Leaders Emerging Market Index (KNLGEX), an index of the 165 most innovative companies in the emerging economies, compared to copper prices. There has been a huge divergence in the emerging markets in the last five years--toward companies with significant stocks of intangible capital.

The KNLGEX has the following measurements relative to the MSCI Emerging Markets Index:

1) 80% active share, making it a high active share strategy.

2) 56% correlation, offering good diversification opportunity.

3) 7% alpha, which can add to portfolio efficiency.

Click here for more information on the indexes.

Stay tuned for more news on our strategic beta-style indexes.

Please email info@gavekal-usa.com for more information.