Performance in the emerging markets has been highly differentiated so far in 2015. Similar to the developed markets, EM Asia is by far the best performing region in the emerging markets. The average stock in the EM Asia index is up an impressive 4.22% YTD. The health care and technology sectors are both up nearly 10% and only one sector, utilities, is down for the year. Contrast this positive performance with the carnage currently (quietly?) taking place in EM Latin America. The average stock in EM Latin America is down nearly 10% YTD. All 10 sectors in the EM Latin America index are negative on the year. Half of all the sectors are currently in a correction (down 10%) and the health care sector is in a full on bear market (down 27% YTD). The stronger dollar is undoubtedly affecting EM Latin America more than other areas in the emerging market (see chart below).

MSCI EM Asia Performance By Sector

MSCI EM Latin America Asia Performance By Sector

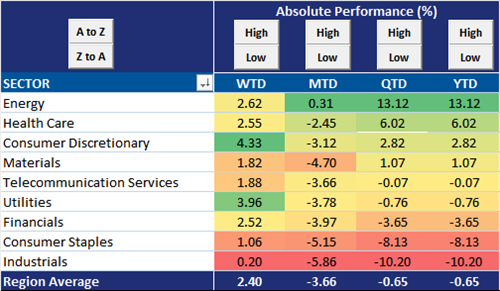

MSCI EM EMEA Performance By Sector