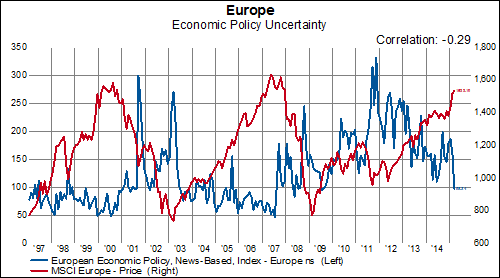

However, when we look at a simple correlation of the overall Economic Policy Uncertainty index for Europe and the performance of MSCI Europe stocks, we find only a slightly negative correlation-- meaning that declines in uncertainty provide only minimal support for equities. As we can see in the following chart, significant gains seem more assured when the index remains in a tight range below 100 on a consistent basis:

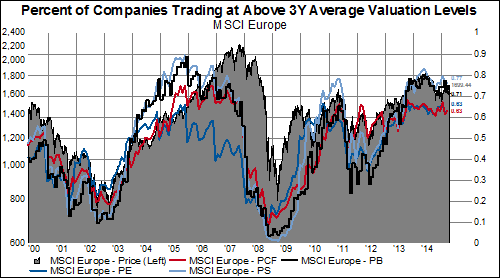

Perhaps we would be more optimistic about the potential for large gains in European equities if it appeared that there was more room for multiple expansion? The fact that two-thirds (or more) of stocks in MSCI Europe continue to trade above their three-year average valuation levels (no matter which one you choose) remains a concern.

*Economic Policy Uncertainty