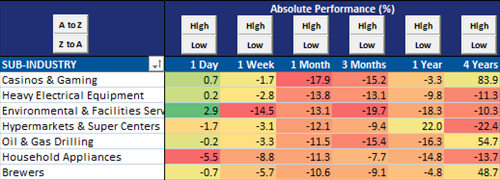

Performance has suffered, especially over the last month, leaving the sub-industry in the bottom ten of all the MSCI Europe groups (not just its Consumer Staples peers):

Maybe that isn't so surprising, given the underperformance of the Consumer Staples sector overall:

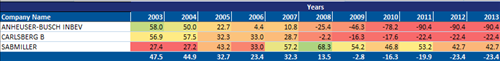

As we have seen before, a group's lackluster performance can often be attributed to a single, struggling member. In this case, however, all of the European Brewers that pass our knowledge leaders screen seem to be having difficulty:

What is the source of this general malaise among the Brewers?

Cash balances remain mostly healthy relative to the last decade...

While debt levels are improved since 2007:

Free cash flow as a percent of sales looks pretty solid over the last five years or so:

While gross margins continue to grow-- from an average of ~20% two decades ago to over 50% now-- the pace of that growth has slowed a bit in the last decade:

Though AB InBev stands out when it comes to efficiency in the form of the cash conversion cycle, the Brewers are generally a proficient group when compared to other sub-industries in the sector:

ROIC has recovered nicely from recessionary lows:

So far, we have found no glaring weakness on the balance sheet, the cash flow statement, or with respect to profitability and efficiency measures.

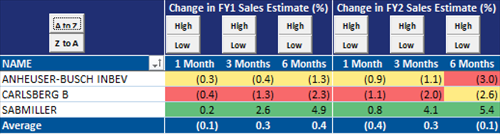

But sales and earnings estimates have been downgraded, on average, over the last six months:

And, though our intangible-adjusted valuations do not appear to be too stretched...

A longer-term view reveals that P/CF has roughly doubled for the average stock in this sub-industry since 2007:

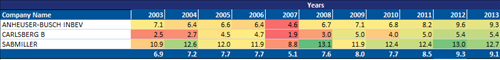

Finally, these companies' investments in intangibles as a percent of overall sales is, on average, stagnant over the last 15 years:

To sum up, it would appear that the Brewers are suffering from somewhat extended valuations in an environment that has seen falling demand worldwide-- a situation not dissimilar to that facing the Distillers & Vintners that we discussed a while back. And, while the fundamentals seem mostly solid (for now), it seems that these companies could benefit from a greater focus on intangible investments like the one that put a smile on even the most depressed Broncos fan's face at the end of last night's game.